Dollar Stabilises After Fed Cut as Sterling and Yen Await Central Bank Decisions

- admin cys

- Oct 1, 2025

- 4 min read

A Report by CYS Global Remit Counterparty Sales & Alliance Unit

Global currency markets remained volatile on Thursday, as the U.S. dollar steadied from sharp swings in the wake of the Federal Reserve’s interest rate cut. Sterling drifted lower ahead of the Bank of England’s policy decision, while the Japanese yen traded cautiously before key inflation data and the Bank of Japan’s meeting on Friday.

Fed Rate Cut Sparks Dollar Whiplash

The U.S. dollar saw significant turbulence after the Federal Reserve delivered a widely anticipated 25 basis point cut on Wednesday. The move initially sent the greenback tumbling to its lowest level since early 2022, with the Dollar Index sliding to a 3-½ year trough. However, the currency quickly reversed course, bouncing higher after Fed Chair Jerome Powell struck a careful tone in his post-meeting remarks.

On Thursday, the Dollar Index—tracking the greenback against six major peers—was 0.1% higher at 96.605. The modest recovery followed Wednesday’s sharp decline, underscoring ongoing investor uncertainty about the U.S. rate outlook.

Powell characterized the decision as a “risk-management” cut, citing signs of strain in the labour market but pushing back against expectations for aggressive near-term easing. The Fed’s dot plot projections indicated another 50 basis points of cuts across the remaining two meetings this year, but only one further reduction pencilled in for 2026.

This more restrained approach stood in contrast to some market hopes for a faster pace of easing and to political pressure from President Donald Trump, who has openly called for deeper cuts. Notably, Trump’s appointee to the Fed board, Stephen Miran, dissented in favour of a larger 50 bps cut, reflecting the split between policymakers and political demands.

Analysts at ING argued that despite Powell’s guarded stance, the central bank has clearly shifted to a more dovish footing. “Regardless of the market’s hectic reaction, we read this as a negative event for the dollar,” ING wrote, pointing to the Fed’s renewed emphasis on the employment mandate.

Attention now turns to fresh U.S. labour market data. Weekly jobless claims, due later Thursday, will be closely watched after an unexpected jump in filings last week. Any further signs of weakness could strengthen expectations for more aggressive Fed action, weighing again on the dollar.

Sterling, Euro and European Policy Dynamics

Across the Atlantic, the British Pound slipped modestly against the Dollar, with GBP/USD down 0.1% at 1.3610. The decline followed a brief surge to multi-week highs in the prior session. Traders are positioning cautiously ahead of the Bank of England’s policy decision later Thursday. The BoE is widely expected to keep its benchmark rate unchanged at 4%, following five cuts since August 2024. Yet, with consumer price inflation running at 3.8% in August—it’s highest in 19 months and nearly double the central bank’s target—policymakers face a delicate balancing act. Markets anticipate one more cut before year-end, but sticky inflation complicates the outlook.

Meanwhile, the Euro extended recent gains, supported by Dollar weakness. EUR/USD rose 0.2% to 1.1837, after briefly touching 1.1918 on Wednesday—its strongest level since mid-2021. The European Central Bank left rates steady last week but signalled policy flexibility amid uncertainty over trade, energy costs, and foreign exchange dynamics. ING analysts forecast the euro to consolidate around 1.185 in the near term, with a longer-term target of 1.20 by the fourth quarter. Such a move would mark a significant milestone for the single currency, underscoring its relative resilience against a softer dollar backdrop.

Yen, Yuan and Broader Asia-Pacific Moves

In Asia, the Japanese Yen held firm after recent gains, with USD/JPY steady near 147.07. The currency briefly strengthened on Wednesday but eased back as traders awaited Friday’s Bank of Japan meeting. Markets overwhelmingly expect the BOJ to leave rates unchanged, but sticky inflation and political uncertainty could shape the central bank’s tone.

Japan’s consumer price index for August is also due Friday and is expected to show inflation remaining above the BOJ’s 2% target. Persistent price pressures have fuelled speculation that the central bank may still be forced to hike rates later this year, particularly if inflation proves more entrenched than policymakers expect.

In China, the Yuan cooled slightly, with USD/CNY rising 0.1% to 7.1073. The move followed a rally that took the currency close to 10-month highs, supported by Beijing’s stepped-up efforts to stimulate domestic consumption. This week, Chinese authorities pledged further measures to shore up household spending after a run of disappointing economic data.

Commodity-linked currencies were weaker. The Australian Dollar slipped, with AUD/USD down 0.1% to 0.6642, retracing from a recent 10-month high. The New Zealand dollar fared worse, tumbling 0.9% to 0.5910 after data showed the economy contracted in the second quarter. The contraction reinforced expectations that the Reserve Bank of New Zealand will need to pursue deeper rate cuts to cushion growth.

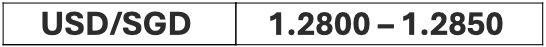

Elsewhere, broader Asian currencies traded mixed. The Indian Rupee, South Korean Won, and Singapore Dollar all slipped modestly against the greenback. The Rupee has been under pressure, having notched a series of record lows in recent weeks. While the prospect of lower U.S. rates offers some relief for Asian markets, lingering concerns over U.S. economic momentum and global trade are tempering risk appetite. Safe-haven assets such as gold and the yen have found support as investors hedge against downside risks.

Outlook: Markets Brace for Data and Central Bank Clarity

With the Fed’s latest move behind them, markets are entering a period where labour market data and central bank commentary will drive direction. Thursday’s U.S. jobless claims will provide an early test of whether the recent spike in unemployment filings was a blip or a sign of deeper weakness.

In Europe, the BoE’s decision will be scrutinized for how policymakers balance inflation concerns against slowing growth. For Japan, Friday’s inflation data and BOJ commentary will be critical in shaping expectations of whether the central bank sticks to ultra-loose policy or edges toward tightening.

For now, the dollar has stabilized, but its longer-term trajectory remains clouded by the Fed’s dovish shift and fragile investor confidence in the U.S. economy. Sterling and the euro will trade on central bank contrasts, while Asia’s currencies remain caught between domestic fundamentals and the broader drag of global monetary easing.

Sources: