Dollar Holds Firm Amid Fed Independence Concerns

- admin cys

- Sep 4, 2025

- 4 min read

A Report by CYS Global Remit Counterparty Sales & Alliance Unit

U.S. Dollar Resilient Despite Fed Independence Questions

The U.S. dollar staged a modest rebound midweek, though gains remained capped by fresh concerns over the independence of the Federal Reserve. At 05:25 ET (09:25 GMT) on Wednesday, the Dollar Index, which tracks the greenback against a basket of six major currencies, traded 0.4% higher at 98.487, retracing some of its losses earlier in the week.

The political backdrop in Washington overshadowed trading after U.S. President Donald Trump announced plans to dismiss Federal Reserve Governor Lisa Cook. Trump accused Cook of improprieties related to mortgage loans, a charge that has not been independently verified. Cook responded through her legal team that the president has no authority to remove her from office, insisting she would not resign.

The clash raises profound questions about the independence of the U.S. central bank. Governors on the Federal Reserve Board are appointed for 14-year terms precisely to insulate monetary policy from short-term political interference. Trump’s action risks setting a precedent that could politicize the Fed and undermine confidence in its decision-making. Market participants, however, have been slow to react. Analysts at ING argued that “Trump’s firing of Fed Governor Lisa Cook and the broad view that this marks further politicisation of the Fed are negative for the dollar. Yet, the FX reaction has been muted and may only play out in the longer run.”

There are two key reasons for the subdued response. First, Cook is challenging the dismissal, which means the legal process could drag on for months, limiting immediate impact on policymaking. Second, the Fed’s current direction remains anchored by Chair Jerome Powell, who has emphasized data-driven policy. With the Board’s dovish voices still in the minority, Cook’s potential absence is unlikely to sway near-term decisions on interest rates.

Indeed, traders remain focused on the path of U.S. monetary policy. Market pricing indicates an 85% probability of a 25-basis-point rate cut at the Fed’s next meeting, reflecting expectations that softer inflation and weakening demand will prompt easing. This outlook has kept the dollar supported despite political turbulence.

Europe Under Pressure: France and Germany Weigh on Euro

Across the Atlantic, the euro weakened, with EUR/USD falling 0.5% to 1.1586. Political instability in France and deteriorating German sentiment data combined to pressure the single currency.

In France, Prime Minister Francois Bayrou faces a confidence vote on September 8, tied to his contentious budget proposals. A defeat could force President Emmanuel Macron to reshuffle his government, appoint a new prime minister, or potentially call a snap election. Each option carries significant risks for market stability.

“Markets are still making up their minds about the aftermath of the upcoming confidence vote and don’t seem in a rush to price snap elections as the baseline scenario,” said ING analysts. They added that a more likely alternative may involve a new government softening spending cuts to secure parliamentary backing. However, they noted that this path remains narrow, given heightened scrutiny over France’s fiscal commitments within the eurozone.

Meanwhile, German consumer confidence continued its decline. The GfK index fell to -23.6 in September, marking the third consecutive monthly drop and underscoring persistent headwinds from high living costs and weak growth. This deterioration highlights the eurozone’s fragile recovery, limiting the European Central Bank’s policy flexibility.

The British pound also traded lower, with GBP/USD slipping 0.3% to 1.3445. Still, sterling drew some support from the Bank of England’s hawkish tone, which has signaled concern about entrenched inflation pressures. ING analysts suggested that a “structural break above 1.35 is a matter of when rather than if,” pointing to underlying resilience in the pound despite near-term softness.

Asian FX Mixed; Indian Rupee Faces Tariff Pressures

Asian currencies showed modest strength on Thursday, with regional markets shrugging off the U.S. political drama. The Dollar Index fell 0.2% in Asia trading, paring gains from the prior session.

The Japanese yen strengthened slightly, with USD/JPY down 0.2%.

The South Korean won advanced, pushing USD/KRW lower by 0.4%, after the Bank of Korea kept interest rates steady at 2.50% for a second consecutive meeting.

The Chinese yuan was little changed, with both onshore (USD/CNY) and offshore (USD/CNH) pairs flat.

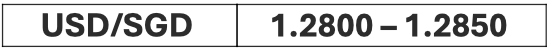

The Singapore dollar edged higher, with USD/SGD marginally lower.

The Australian dollar extended gains, with AUD/USD up 0.2% after stronger-than-expected inflation data cast doubt on the Reserve Bank of Australia’s ability to continue cutting rates.

The Indian rupee remained the clear underperformer. The currency traded near record lows, with USD/INR hovering around 87.99, pressured by escalating trade frictions. On Wednesday, the U.S. doubled tariffs on Indian imports to 50%, targeting goods linked to India’s continued purchases of Russian crude oil. The rupee has been under sustained selling pressure since May, falling for four straight months and declining in eight of the past nine weeks. Analysts warn that ongoing tariffs, coupled with capital outflows, could push the currency into uncharted territory, raising the risk of further intervention from the Reserve Bank of India.

Outlook: Policy Uncertainty Meets Market Caution

Global currency markets enter September grappling with an unusual combination of political turbulence and monetary policy divergence. In the U.S., Trump’s attempt to remove a sitting Fed governor has fuelled concerns about institutional independence, but traders remain focused on the Fed’s upcoming policy move. The dollar’s resilience reflects investor confidence that Powell will maintain a data-dependent stance, even under political pressure.

In Europe, the euro faces multiple headwinds: French political instability threatens fiscal reform momentum, while Germany’s consumer malaise highlights the bloc’s fragile growth outlook. Without a clear improvement in sentiment, the euro’s recovery prospects remain limited.

In Asia, currencies remain broadly stable, though the Indian rupee continues to stand out as a weak link. U.S. tariffs amplify structural vulnerabilities in India’s trade and current account position, leaving the currency vulnerable to further declines.

For now, subdued volatility masks deeper concerns. As ING noted, the long-term implications of a politicized Fed could be far-reaching, with credibility, investor trust, and even the dollar’s reserve status at stake. But in the short term, markets remain anchored to data and policy signals, rather than political headlines.

Sources: