Asian Currencies Edge Higher as Dollar Slips Ahead of Fed Decision

- admin cys

- Sep 17, 2025

- 4 min read

A Report by CYS Global Remit Counterparty Sales & Alliance Unit

Asian Currencies Steady as Dollar Weakens Ahead of Fed Rate Cut Decision

Asian currencies mostly edged higher this week, as the dollar slipped on firm expectations that the U.S. Federal Reserve will deliver a rate cut at its policy meeting next week. Sticky consumer inflation data in the United States did little to shift those expectations, while regional factors drove mixed performances among Asian currencies.

Rupee Weakens on Trade Tariff Concerns

The Indian rupee stood out as the weakest performer in Asia, sliding to a record low of 88.499 per dollar in the prior session before stabilizing slightly on Friday. The rupee’s losses were fuelled by fresh geopolitical trade concerns, after reports emerged that Washington was pressing the European Union and G7 nations to impose tougher tariffs on Russian oil buyers — a move targeting both India and China. Currently, both countries face tariffs of around 50% on exports to the U.S. President Donald Trump has reportedly urged that these rates be doubled, raising the risk of a significant escalation in trade frictions.

The tariff news largely overshadowed positive signals from ongoing U.S.-India trade discussions, with officials confirming that talks will continue in the coming weeks. As a result, the USD/INR pair still ended the week 0.2% higher, reflecting persistent investor caution. The rupee’s weakness highlights India’s vulnerability to geopolitical headwinds, especially given its reliance on oil imports and sensitive trade links. A prolonged dispute over tariffs could exacerbate inflationary pressures and weigh on capital flows into the country.

Commodity and Tech Tailwinds Lift AUD, TWD

In contrast, the Australian dollar outperformed regional peers, ending the week 1.8% higher against the U.S. dollar. The AUD/USD pair gained 0.1% on Friday, buoyed by stronger commodity markets, particularly metals. With global demand for raw materials expected to recover alongside potential easing in global financial conditions, the Australian dollar has enjoyed renewed momentum.

The Taiwan dollar also strengthened, with the USD/TWD pair falling 0.8% over the week. The move was supported by robust foreign capital inflows into local technology stocks, reflecting global investor appetite for the semiconductor and electronics sectors. Optimism over lower U.S. interest rates further bolstered demand for risk assets, which translated into support for Taiwan’s currency.

Meanwhile, the Chinese yuan (USD/CNY) rose 0.1% on Friday, settling into a relatively stable position for the week. The yuan recently touched near 10-month highs on the back of strong policy support from Beijing. However, lacklustre trade and inflation figures released this week dampened sentiment, underscoring persistent concerns about China’s slowing growth trajectory.

The Japanese yen also experienced heightened volatility, whipsawing after Prime Minister Shigeru Ishiba’s abrupt resignation earlier in the week. Political uncertainty weighed on investor sentiment, although the USD/JPY pair ultimately rose 0.2%, leaving the yen marginally weaker on the week.

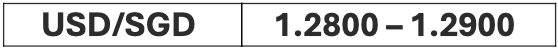

Elsewhere, the Singapore dollar ticked 0.1% higher, while the South Korean won fell 0.1%, reflecting relatively subdued trading across the broader Asian currency complex.

Dollar Index Slips, Fed Rate Cut in Focus

The U.S. dollar weakened this week, with the dollar index and dollar index futures down around 0.2% in Asian trade. The greenback lost ground on Thursday after U.S. consumer inflation data painted a mixed picture.

Headline CPI rose slightly above expectations in August, keeping inflation concerns alive. However, core CPI — which strips out volatile food and energy components — matched forecasts, offering reassurance that underlying price pressures remain contained. Market participants interpreted the data as supportive of the view that recent tariff-driven inflation spikes will be limited, especially in the context of a cooling labour market. This sentiment helped cement expectations that the Federal Reserve will cut interest rates by 25 basis points at its September 16–17 policy meeting. According to CME’s FedWatch tool, traders are pricing in a 96.8% probability of a 25 basis-point reduction, and only a 3.2% chance of a larger 50 basis-point cut.

The prospect of lower borrowing costs has put pressure on the dollar, while simultaneously supporting risk assets and emerging market currencies. Nevertheless, uncertainty remains over the Fed’s longer-term trajectory. With inflation still sticky and trade-related risks rising, markets remain divided on whether the central bank can continue easing aggressively in the months ahead.

Outlook: Policy Divergence and Trade Risks to Drive Markets

Looking ahead, next week’s Fed meeting will be the defining catalyst for global markets. A widely anticipated 25 bps cut could reinforce the dollar’s softening trend, lending support to Asian currencies. However, the depth and tone of the Fed’s forward guidance will be equally important — especially whether policymakers signal room for further easing this year.

For Asia, domestic and geopolitical developments remain crucial drivers. The Indian rupee faces further downside risk if tariff disputes escalate, while the Australian dollar and Taiwan dollar are positioned to benefit from supportive external demand in commodities and technology. The Chinese yuan remains a wildcard, as Beijing balances stimulus measures against weak economic fundamentals. Meanwhile, political uncertainty in Japan and moderate gains in Southeast Asian currencies suggest a landscape of mixed resilience across the region.

Overall, while the dollar’s retreat has given Asian currencies some breathing room, the outlook hinges on a delicate balance of monetary policy shifts, trade disputes, and domestic economic resilience.